The Nigeria Education Loan Fund (NELFund) has explained that the government’s student loan scheme is currently limited to public tertiary institutions to ensure that the nation’s limited resources are used to support as many students as possible.

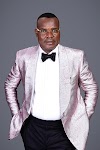

Speaking during an interview on Arise TV, the Managing Director of NELFund, Akintunde Sawyerr, revealed that the decision to exclude private institutions was driven by the need to target the most vulnerable students, many of whom attend public institutions where tuition fees are relatively low.

“We’re working with public funds, and the resources are limited. Most of the students who need this support are in public schools, where fees are affordable. It’s about prioritising and helping more people with the available funds,” Mr Sawyerr explained.

Possible inclusion of private institutions?

While the scheme is currently exclusive to public schools, Mr Sawyerr hinted at the possibility of expanding to private institutions in the future.

He said: “When I spoke with the President (President Bola Tinubu), he expressed his desire that the fund should be available to all Nigerians. But you have to manage funds and start somewhere. I do not doubt that at some point in the future, it will be expanded.”

He acknowledged that fees in private institutions are significantly higher, sometimes running into millions, “which makes it challenging for the current funding structure to accommodate them.”

“We’re focused on trying to help as many as possible, rather than a few. We have to manage funds,” he added.

According to Mr Sawyerr, the Fund has already disbursed N10 billion to about 90,970 students, with plans to disburse an additional N92 billion for the next academic session.

The scheme, initially signed into law by President Bola Tinubu in June 2023, provides interest-free loans to cover institutional fees and a monthly allowance of N20,000 for upkeep.

Mr Sawyerr highlighted that the application process began in May 2024 with a pilot phase targeting federal institutions.

The loan covers tuition fees, paid directly to the schools, and beneficiaries are expected to begin repaying two years after completing their National Youth Service Corps (NYSC) programme, provided they are employed.

The repayment process involves employers deducting 10 per cent of a beneficiary’s salary until the loan is fully repaid.

Geographical disparities in applications

On the issue of loan applications, Mr Sawyerr noted a regional disparity, with more applications coming from northern Nigeria.

He attributed this to a higher concentration of public institutions in the north, as well as cultural differences in attitudes toward loans.

“We noticed that a good number of the people from the south study in the north and have applied. There’s a sort of geographical disparity but not by state of origin. There seems to be a lesser level of enthusiasm in the southeast, south-west, and south-south,” he said

He also addressed concerns about the loan application process, emphasising that NELFund has adopted an electronic, data-driven system to minimize human interference and reduce the risk of corruption.

He added that applicants are required to provide unique identifiers, including their JAMB number, National Identification Number (NIN), Bank Verification Number (BVN), and matriculation number, which he said are verified against institutional records.

“We match it with what the institution has provided us and know that we are dealing with an individual. It’s an IT-based system. They’re bound to have challenges but it’s a generally simple portal to engage with,” he said

While there have been some challenges with the online application process, Mr Sawyerr reassured that the Fund’s support staff are available to resolve any issue.

He said: “We recognise that anywhere you have systems like this, you can have people attacking the site, wanting to insert ghost students, and doing identity hijacking. We are very careful to put in place processes that ensure we don’t pay people who sneak into our database.”

.png)

0 Comments

DISCLAIMER

The views and opinions expressed on this platform as comments were freely made by each person under his or her own volition or responsibility and were neither suggested nor dictated by the owners of News PLATFORM or any of their contracted staff. So we take no liability whatsoever for such comments.

Please take note!